Contact Us

We'd love to get to know you and your business better. Let us know how we can help.

Accountable Bookkeeping, LLC

309 East Main Street, New Holland, Pennsylvania 17557, United States

O: 717.351.4105

F: 717.351.5244

Contact Us

Signup to receive our eNewsletter. By

Newsletter Sign-Up

Recent News

Do you have concerns about using AI in the office place? Here are a few things to keep in mind. Pro: Efficiency | Con: Dependency on Technology While there is truth about the efficiency of AI doing repetitive, simple tasks for you in the office (taking notes, writing a simple email, etc.) there is also the inconvenience of relying on technology to take care of these simple tasks. And we all know how it feels when technology fails us. There is also the concern that AI will cause employees to rely too heavily on it for decision-making and ideas causing them to lose their own creative and unique solutions and ideas. One thing AI is not, is unique- but your business is! So, when you are using AI for simple office tasks, take into consideration what you might lose in the long run and weigh if that is worth it to your business.

Did you know that there is a minimum wage in our state? The minimum wage in PA is $7.25 per hour matching the federal minimum wage set in 2009. However, the minimum cash wage for tipped employees is $2.83 per hour. There are certain professional, administrative and executive roles that are exempt from minimum wage and overtime requirements if they meet specific salary and duty tests. As of now legislative proposals are ongoing to increase this rate. If you would like more information regarding this, please contact our payroll department.

You may have noticed that when you view your chart of accounts, there is a column for “QuickBooks Balance” and one for “Bank Balance” , and they don’t match. That does not necessarily mean that your QuickBooks balance is incorrect. QuickBooks (QB) registers records, checks, and deposits as soon as they are entered , whereas the bank balance is only affected when the check or deposit actually clears the bank. These are often checks that have been written in QB that haven’t cleared the bank (outstanding checks), or deposits that have been recorded in QB that haven’t cleared the bank (deposits in transit). The only way to verify that your QB balance is correct is to do a “Bank Reconciliation” in QuickBooks. For more information on how to perform a Bank Reconciliation or to get help with your Bank Reconciliation, feel free to contact our QBO Bookkeeper!

The new year is here, and you feel busier than ever. Here is one simple rule to follow to help stay organized. Clean as you go. This applies in admin organization just as much as it does in your kitchen. As you are doing your normal tasks, noticing things that aren’t in the right file , aren’t labeled correctly , etc., clean them up now , while you’re thinking about it and looking at it. Yes, it will take a little extra time now, but it will save you much more time and stress in the long run.

Due to the One Big Beautiful Bill Act (OBBBA) that was passed into law on July 4th of this year, there were some updates to the tax landscape, including new deductions for qualified overtime pay. This provision allows for a tax deduction on personal returns for qualified overtime pay, capped at $12,500 per individual. Overtime will continue to be taxed on paychecks. The deduction applies only to the overtime hours required by the FLSA (typically work over 40 hours a week). It specifically covers the additional “half” of time and a half pay. The IRS has announced there are no changes to the standard W-2 form for 2025. Therefore, it is extremely important that your employees provide their tax accountant with their final paystub of 2025 that shows the year-to-date overtime. This will provide them with the accurate amount of overtime that can be used towards this deduction on their 2025 income taxes. Starting in 2026 there will be new ways to track the qualified overtime amounts. We will keep you posted as updates are available. All W-2 forms are required to be filed with the IRS no later than February 2, 2026. Again, there will be no change to the W-2 form in 2025, the last paystub is the proof for taxes. Should you have any questions, please do not hesitate to contact Tina in our payroll department.

Using Bills and Expenses incorrectly can lead to messy accounting and inaccurate reports. Here’s what can go wrong: 1. Duplicated Expenses If you enter a Bill and record an Expense for the same purchase, you’ll double-count the cost — inflating your expenses and lowering profit. Example: You receive a vendor invoice → record it as a Bill. Then, when you pay, you record another Expense instead of Pay Bills. Now your Profit & Loss report shows the same expense twice. 2. Incorrect Cash Flow Recording something as a Bill when it was already paid makes it look like you owe money you don’t. This can throw off your Accounts Payable aging report and make it harder to manage cash flow. 3. Missing Unpaid Vendor Balances If you record a vendor invoice as an Expense (instead of a Bill), QuickBooks® assumes it’s already paid. You’ll lose visibility into what you still owe — which can lead to late payments or missed deductions. 4. Tax Reporting Issues Wrong classifications can distort your expense totals and timing, leading to errors in tax deductions or reconciliations. By understanding when to use each, you’ll keep your vendor records clean, reports accurate, and your accountant happy. If you’re ever unsure, ask yourself one simple question: “Has the money left my bank account yet?” That answer will tell you whether it’s a Bill or an Expense. If you still have questions, contact us!

Happy New Year! The new year means it is time to wrap up 2025 and get your QB file or your records to your tax accountant. Before the tax accountant receives your information, it should be in an organized manner, this saves them time and you MONEY! Here are a couple of the major things to look at: Make sure your checking account and savings accounts are reconciled to the bank statement through 12/31/25 Make sure credit card charges are all entered (these are expenses to you) and then all are reconciled (you may need to wait for the January or February statement to have all December charges) Loan balances also need reconciled, this includes any personal loans as well Look at your P & L - are all transactions classified correctly? Payroll accounts should be reconciled to match your W-2 filings We would be glad to help get your files organized and even get them to your tax accountant! Give us a call!

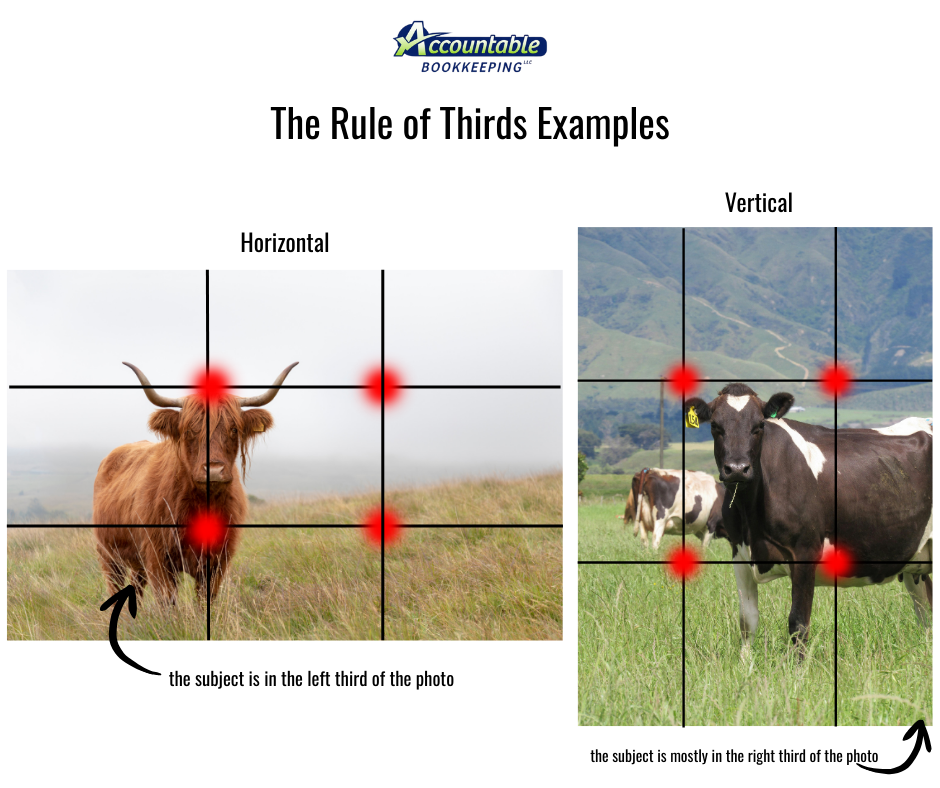

Are you cropping a photo to use in your newsletter, website, or advertisement? Here is an easy rule to keep in mind. The Rule of Thirds is an off-center way to crop (or take) a photo along a 3x3 grid that divides your photo into 9 equal parts. This helps to keep the subject of your photo clear to the viewer. When you crop your photo, identify the most important element or subject of your photo (example: a cow in a field) , then imagine a 3×3 grid (the cropping tool will often have the grid in place), and crop so that your subject (the cow) is at one or two of the 4 intersection points along that grid. This works horizontally and vertically.

To be eligible to be exempt from Social Security and Medicare taxes you must meet the following requirements: You are a member of the Amish Church Complete a form 4029, have it signed by your bishop. Your employer is also Social Security and Medicare Exempt You will continue to have Social Security and Medicare withheld from your paycheck until you receive the approved 4029 form back from the federal government. Your exemption status will go into effect on the first day of the first quarter after the 4029 application was filed. For example, if you filed your application on 11/01/25 your exemption status would go into effect on 1/01/2026. Therefore, you will be reimbursed for any Social Security and Medicare that was withheld after the effective date. Your exemption status is good for life so you will want to keep your approved form in a safe place so you can provide it to any future employers.