We help business owners focus on their definition of success through our guidance and accountability.

Services

Bookkeeping

Payroll

QuickBooks® Online

QuickBooks® Desktop

Blog

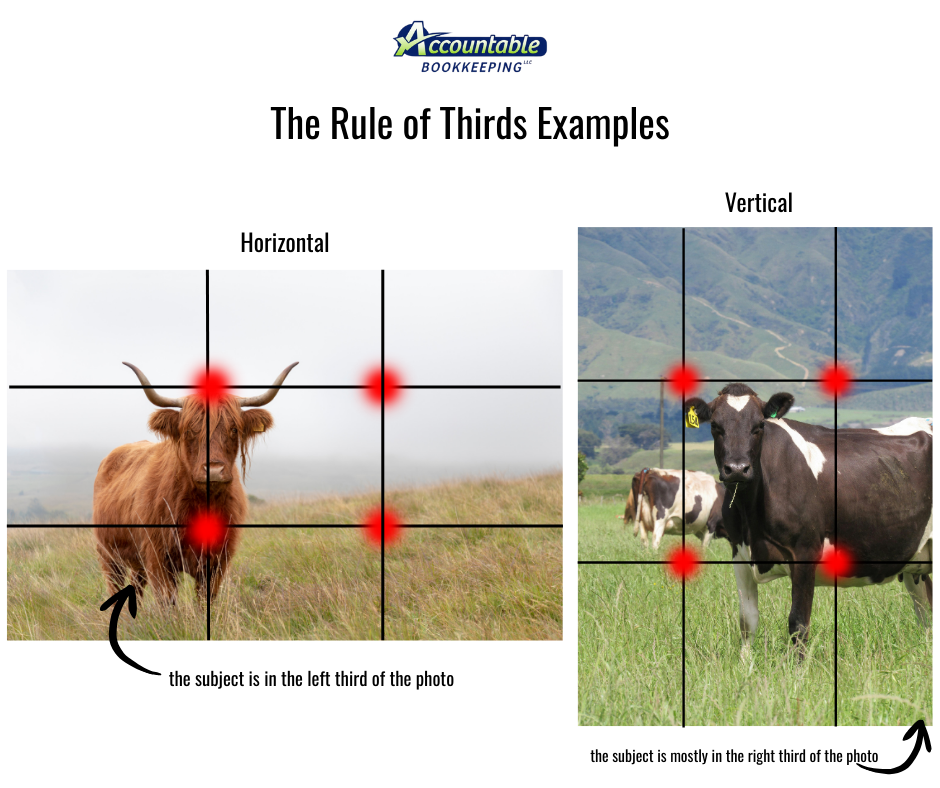

Are you cropping a photo to use in your newsletter, website, or advertisement? Here is an easy rule to keep in mind. The Rule of Thirds is an off-center way to crop (or take) a photo along a 3x3 grid that divides your photo into 9 equal parts. This helps to keep the subject of your photo clear to the viewer. When you crop your photo, identify the most important element or subject of your photo (example: a cow in a field) , then imagine a 3×3 grid (the cropping tool will often have the grid in place), and crop so that your subject (the cow) is at one or two of the 4 intersection points along that grid. This works horizontally and vertically.

To be eligible to be exempt from Social Security and Medicare taxes you must meet the following requirements: You are a member of the Amish Church Complete a form 4029, have it signed by your bishop. Your employer is also Social Security and Medicare Exempt You will continue to have Social Security and Medicare withheld from your paycheck until you receive the approved 4029 form back from the federal government. Your exemption status will go into effect on the first day of the first quarter after the 4029 application was filed. For example, if you filed your application on 11/01/25 your exemption status would go into effect on 1/01/2026. Therefore, you will be reimbursed for any Social Security and Medicare that was withheld after the effective date. Your exemption status is good for life so you will want to keep your approved form in a safe place so you can provide it to any future employers.

When to Use Bills: Use Bills in QuickBooks Online when you receive an invoice from a vendor but haven’t paid yet. For example: You receive a $2,000 invoice from your graphic designer, due in 15 days. In QBO, you’ll record it as a Bill under + New → Bill. Later, when you actually pay it, you’ll go to + New → Pay Bills. This approach keeps your Accounts Payable (A/P) accurate and ensures you can track unpaid vendor balances and upcoming payments. When to Use Expenses: Use Expenses when you’ve already paid the vendor — immediately or on the same day. For example: You pay $100 at Office Depot for supplies using your business debit card. In this case, you’ll record an Expense under + New → Expense. QuickBooks will immediately reduce your bank balance and record the purchase. Think of it this way: Did I already pay for it? → Record an Expense Do I still owe money? → Record a Bill And when you pay the Bill later, don’t enter a new Expense — use Pay Bills in QuickBooks Online. If you still have questions, contact us!

As year-end approaches, start looking at your QuickBooks file for 1099 recipients. QuickBooks does have a 1099 summary report, however the eligible vendors must be set up correctly in order to show on that report. In the vendor set up, click on Tax settings. Be sure to check the box that says, “vendor eligible for 1099” and enter the tax identification number. It is important to receive a W9 form from each of your 1099 vendors to make sure of the entity type, the correct address and correct EIN or SS number are in your file.